[media-credit id=185 align=”alignleft” width=”300″] [/media-credit]

[/media-credit]

UW System President Ray Cross called for an increase in state spending on the UW System to help address the problem of student debt Wisconsin has been facing.

In a press release from Sept. 9 detailing his position, Cross said the UW System needs more money from the state in order to better serve students.

“We help our students through financial aid counseling and assistance, but we want to do more to help them graduate faster while maintaining the excellence our universities are known for,” Cross said. “It’s time to invest in the university system so our students get the help and resources they need.”

UW Oshkosh Chancellor Andrew Leavitt said he is not interested in raising tuition, and wants students to graduate as quickly as possible.

“What I want to do is make sure that we have the proper resources to provide a high quality education to you and deliver it on time so you can come in and out of here and be successful in the shortest amount of time possible,” Leavitt said. “The idea that college presidents and chancellors are wringing their hands thinking of ways to extract more money from students is simply not true.”

According to Leavitt, the trend of the state subsidy lowering and tuition being frozen in recent years will eventually have an adverse effect on the education UWO provides.

“At some point, with this kind of curve, it’s going to impact quality,” Leavitt said.

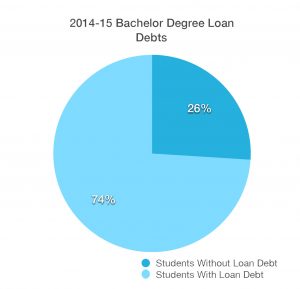

Cross said the decreasing amount of money going to universities is forcing students to take out more loans and pay more for school in general.

“Of course, students would prefer to use grants to pay for college, but when federal and state funding declines, it makes college more expensive for students and expands their reliance on loans to finance their education,” Cross said.

Sophomore Joe Backmann said he believes the state should increase spending on colleges due to the rising costs of education.

“College is getting more expensive every day, people do need more student loans to help them get through it,” Backmann said.

Leavitt said the federal government should decrease the amount of interest on student loans in order to help the American economy.

“I wish the interest rate were lower,” Leavitt said. “6.8 [percent] is way too high. In this country we ought to be charging 0.1 percent for a student loan. It would drive so much economic prosperity.”

According to Leavitt, the government making less money off students is one solution to the mounting costs of getting a degree.

“That’s one of the ways of making college more affordable, is to get the federal government out of the profit business on student loans, which is what they’re doing now,” Leavitt said.

Leavitt said higher education is unique in how it gauges its cost for students looking to attend a university.

“We’re the only industry that I can think of where we factor the cost of living into our product,” Leavitt said.

According to Leavitt, college is obviously very expensive, but much of the cost would be incurred by students even if they weren’t in school.

“Forty-five percent of the expenses you pay are directly related to the classroom,” Leavitt said.

“Fifty-five percent are not. As a matter of fact, that 55 percent, you would pay that even if you weren’t in school.”

Backmann said living off campus can be cheaper than the expected cost of room and board, although underclassmen do not get that option.

“Here we have to live in the dorms for two years; it definitely gets pretty expensive when you look at the first two years,” Backmann said.

According to Leavitt, most students with extreme loan debt acquire it from outside loaners; the maximum amount that can be borrowed through the government’s Stafford loan program is $28,000 over four years.

“When somebody says ‘I have $100,000 in student debt’, I say to myself. ‘How did they get into that much debt,’” Leavitt said. “What they did is they borrowed [the max through Stafford loans] and then they went out to the open market.”

According to Leavitt, most students who finish school pay off their loans within a reasonable time frame.

“The other thing that always baffles me is people say. ‘You will spend a lifetime paying your student loans,’” Leavitt said. “I don’t know how that’s possible. If you are in the Stafford program, there is a ten year payment schedule. It’s like buying a car.”

Leavitt said although UWO could do better as an institution to cut costs for students, he believes student loans are a good investment for students who finish college.

“You use a student loan as a tool to make an investment in yourself,” Leavitt said. “That investment pays off many, many times over in a lifetime. It’s been shown that you’re going to make about a million dollars more over a lifetime with a bachelor’s degree versus somebody who doesn’t.”

Backmann said he believes it takes perspective to see a college education as an investment.

“I think over time it’s easier to realize it as an investment as you’re farther along in the process,” Backmann said. “I think over time I’ll treat it as more of an investment.”

According to Leavitt, the benefits of a college education extend beyond financial incentives.

“You’re going to, in my opinion, live a more fulfilling life in the sense that you learned knowledge and skills in college that helps transform you as a citizen,” Leavitt said.”