Local business owners in downtown Oshkosh said they are preparing for the tariffs on all imports into the U.S. to kick in, as various items could soon become more expensive.

“It’s buying ahead as much as we can before we know that the price increases are coming and just trying to stock up a little bit for now,” Erica Mulloy, a partner with Satori Imports, said.

According to NPR, President Donald Trump announced a minimum baseline tariff of 10% on all imports crossing the U.S. border starting April 5.

Additionally, the BBC reported that Trump imposed higher tariffs on more than 60 countries, calling them the ‘worst offenders,’ ranging from 20% for the European Union to 46% for Vietnam.

CNN said that a 90-day pause was announced for more than 60 nations, with China as the exception, facing a tariff increase of 125%.

According to a statement from the White House, tariffs seek to balance the trade deficit and provide an incentive for greater manufacturing capabilities to create more “made in America” goods.

Sarrah Larson, owner of Wagner Market, which sells a variety of foods, said she doesn’t know whether her store will be affected.

“All of our meats are from the Midwest, all the cheese is from Wisconsin … liquor might be from a few different countries, ” Larson said. “I try to just source everything as local as possible.”

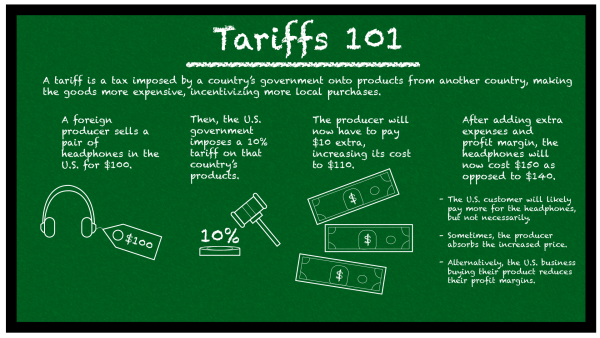

Marianne Johnson, a professor of economics at UWO, said tariffs are a tax placed on goods when they are imported into the country, and the response from businesses will vary by industry and firm.

“[Businesses] have publicly stated that they intend to pass the tariff cost onto consumers through higher prices,” Johnson said. “In this case, you might expect to see higher prices within a couple of weeks of tariffs taking effect.”

Parker Sweeney, an employee at Eroding Winds Record Shop, said tariffs are likely to increase the price of records because the majority are imported from the U.K. and the Czech Republic.

“The tariffs will affect the record industry because a lot of that work is being done overseas,” Sweeney said. “Unfortunately, the customers here will probably see a [price] increase on records.”

Lukas Schmerse, who works at House of Heroes Comics, said there were no changes on imports from Canada and China so far, but anticipates prices to go up.

“Literally everything might go up, like all of our regular comic books: Batman, Spider-Man,” Schmerse said. “It’s the traditional as printed in Canada, so it’s kind of up in the air right now.”

Schmerse said the store’s hardcover Marvel Omnibuses are imported from China and they could become more expensive.

“Those are already like $150,” Schmerse said. “I wouldn’t be surprised if they are like $200 plus.”

Barb Nelson, an owner of Brinkley’s Boutique, said her business won’t be affected by tariffs in the short term.

“We buy our clothing out about a season to a season and a half in advance,” Nelson said. “Everything that could happen right now is not going to affect us because those orders have already been placed.”

Johnson said that small, family-owned restaurants will see higher prices for tomatoes grown in Mexico once the tariffs go into effect.

“Because their profit margins are so thin, they would likely try to pass the costs onto consumers immediately using a ‘tariff surcharge’ applied to meals,” Johnson said.

Drew Landgraf, food and beverage director at Elsewhere Market and Coffee House, said that choosing alternative products can manage influence from tariffs.

“Depending [on] what is impacted, you know, it could be switching brands that we use or, you know, utilizing other resources,” Landgraf said. “Really just depending on what the product is and what the price increase may be.”

Schmerse said that in order to prepare ahead of time before tariffs kick in, they put in a big supply order.

“Bags and boards that protect comics … we put in a big order of those before the price went up,” Schmerse said. “We are going to adjust on a fly … nothing will change on our end until it needs to.”

Sweeney said companies are less interested in opening record-pressing plants in the U.S. because it is cheaper to do so overseas due to cheaper labor and easier resource access.

“They (record industry) aren’t too eager to manufacture or create factories in the U.S. because of how cheap it is to press records in the Czech Republic, or, you know, just in Europe,” Sweeney said.

Nelson said that she supports current tariff actions in Washington, D.C., because they will benefit the U.S. in the long term.

“I don’t think the scare is going to be as strong as what everyone is feeling right now, but I do think there is going to be good,” Nelson said. “We just have to be patient.”

Nelson said that there is some anxiety because she can see her retirement savings decreasing due to tariffs.

“Of course, there are fears as you watch your 401K go lower and lower, and especially at our age, when it will be a need,” Nelson said. “We don’t have the luxury to wait as my children do.”

Johnson said that low-income households will pay relatively more of their annual income in tariffs than high-income households.

“Economists estimate that the current tariffs will mean that households pay about $3,000 more for things this next year than they did last year,” Johnson said. “Coupled with consumers cutting back on spending because they face higher prices, we might expect higher unemployment over the next year as well.”

Johnson said retaliatory tariffs will hurt Wisconsin’s agricultural sector and the Fox Valley’s machinery manufacturing industry by making U.S. products more expensive compared to their competitors.

“Wisconsin’s economy relies a lot on agriculture, [and] China’s retaliatory tariffs will particularly harm farmers that are used to exporting soybeans and ginseng to China,” Johnson said. “The Fox Valley is particularly exposed to tariffs in manufacturing high-quality machinery like firetrucks and generators.”